Download Course Materials

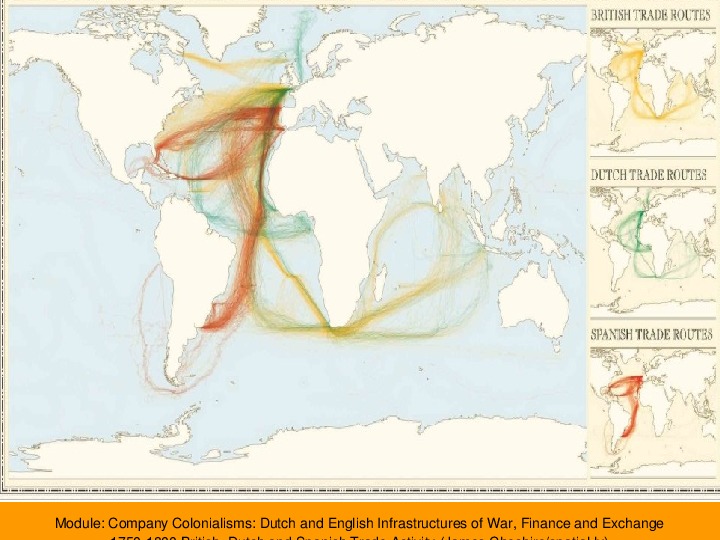

From the 15th Century through the 19th Century the naval power and ocean-going trade routes determined who is the most powerful empire in the world. By the end 17th Century, the Portuguese and the Spanish had largely been crowded out of the Indian Ocean and Asia by the Dutch and the English, both of whom were already making forays into North America as well. In this module, we see how the representation of a country on a map of the world using a uniform color and a sharp boundary tends to often exaggerate the homogeneity of conditions within, and the sharp distinctions with the conditions beyond, its borders. Political maps devoid of geological and topographic features, in particular belie a sometimes extreme unevenness of population distribution, access, and degree of control within nation states while seeming to concentrate differences at political boundaries. Similarly, the vast seas separating the populated places of the earth as barriers. However, advancements in seafaring vessels effectively shrank the distances between sites accessible by water transforming the shape of architecture, cities, infrastructures according to the need to exchange goods, people, and ideas. The underlying conditions that must be satisfied before any exchange can take place are precise and unyielding. Maps of the 15th century explorers demonstrate the primacy of the search for natural harbors that are best suited for building defensible fortified-port-canal-factory-house towns. Against the impressions given by most maps, the primary concern of geopolitics has for most of history been less about large more or less uniformly controlled territories, and more about controlling strategic points along accessible coastlines. The new devices for financial exchange detailed in this sequence of lectures were developed in conjunction with new architectures supporting the activities of merchants and facilitating the accountability and trust that is the basis for the operation of the paper transactions that were central to Europe’s new capacity for flinging itself out across the globe. Company colonialism is the origin of capitalism. It is a system whereby, nation-states outsource the extraction and exploitation to for-profit companies in exchange for an often-exclusive charter fee. Companies relied on a number of financial innovations. Banks and the emerging bond market allowed companies to borrow money to invest in better ships and new routes. The stock market allowed them to sell shares to other owners, both raising capital and diversifying risk. Indeed, this was the key advantage the company had over sovereign fleets. The risk of a single voyage could be pooled among many owners rather than bankrupt a family. As a stockholder, you could hold on the shares and receive the dividend paid once per year upon the conclusion of a voyage, or sell your shares to somebody else for a profit or loss. Initially these were one time deals, shares were liquidated after each voyage. The commodities themselves were worth money, not only in sale, but in what is now known as the “futures” market. You could purchase an option to buy or sell a given item at a fixed price at some date in the future. This is always risky, however, for many this enabled them to know fixed costs months in advance and was worth the risk that they may lose or make money on the deal. For defenders of Efficient Market Theory, this is the best thing about capital markets, they allocate capital efficiently to the best performing companies, rewarding success, and the fewer barriers the more efficiently the capital will be allocated. The enlightenment assumption behind this idea is that people never make poor decisions in their own self-interest. Yet the companies are often structured as Limited Liability Companies, meaning the majority owners and operators are shielded from the consequences of their actions by law. Indeed, most companies had a monopoly without competition from their home country. What is more their right to trade was enforced by military power, often leading to outright war. Charter companies also had the ability to negotiate trade, build, and some cases, the license to wage war. Indeed, historian Sven Beckert calls this, “war capitalism,” as capitalism cannot operate in a vacuum of frictionless exchange. It relies always at some point on violence, whether physical or implied through law. This is arguably a more accurate description, because rarely is any form of exchange for profit completed without some violence or coercion at one point in the system from production to consumption. Indeed, most of the growers, harvesters and crafts people for spice, pepper, tea, sugar, cotton or any valued commodity were slaves, chattel labor or serfs. We choose company colonialism for the four lectures in this module because the extraction of profits for the benefit of the few is shrouded in a new corporate construct that includes the exertion of power, territorial violence and resource extraction that is the essence of all forms of colonialism. The other aspect of the company colonial system is that the benefits are largely concentrated in particular sites due to the relatively new ability to create wealth from invested capital and compound interest alone, without a marketable skill or product. This new form of wealth is visible as architecture and vital to the emerging modern city. For the Dutch, Amsterdam profits off of the extraction centered on Batavia, two urban sites anchored by the Dutch East India Company (VOC). Both sites illustrate the expression of power and profit through their architectures. Indeed, without the VOC, Amsterdam and Holland itself would be far less wealthy and Batavia would not even exist.

supporting documents:

Handout

Lecture Notes

This content has been added to your bundle, . View your bundles.

Your account has not yet been verified by a GAHTC administrator. Once your account is verified, you will be able to download course materials. You will be notified by email when your account has been verified. In the meantime, you can continue to search the site and add resources to your bundles. Thank you!